capital gains tax budget news

Delivery Spanish Fork Restaurants. The highest long-term capital gains rate would rise to 25 while the 38 Medicare surcharge for high-income investors would push that rate to 288.

Federal Budget Tax Changes 2021 Canada

It wasnt in the Liberal election platform but given the NDPs playbook had a hike in the capital gains inclusion rate to 75 per cent some worry the NDP may hold some sway over the Liberals in setting tax policy for.

. With the new NDP - Liberal coalition will this proposal become a reality in the federal budget. Exemption under section 54 can be claimed in respect of capital gains arising on transfer of a capital asset being long-term residential house property. Essex Ct Pizza Restaurants.

28 Apr 2022 1013 AM IST. News Analysis and Opinion from POLITICO. Capital Gains Tax News.

On April 7 2022 the Federal Budget will be released. Investors breathed a sigh of relief as a predicted hike in capital gains tax did not become reality in. NewsNow brings you the latest news from the worlds most trusted sources on Capital Gains Tax.

1 day agoThe capital gain is 550000 euros minus the 230000 euros remainder loan totalling 320000 euros. Once again no change to CGT rates was announced which actually came as no surprise. 08012018 0309 PM EDT.

Could an increase to say 67 as it was from 1988-89 or 75 as it was from 1990-1999 happen. Its important to note that Biden is also proposing a tax hikethat will raise the top income tax bracket from 37 to 396. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

No discussion of personal tax changes would be complete without the annual warning about a potential increase in the capital gains inclusion rate. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely. For example if an individual taxpayer were to extract 1000000 of corporate funds as a capital gain instead of paying a non-eligible dividend the tax savings would be 210200.

In your tax return the 330000 euros for the house is tax deductible. The Finance Minister Nirmala Sitharaman announced the capping of the surcharge on the long term capital gains payable on capital assets at 15 percent. Following a simplification review Capital Gains Tax CGT is an area that we have been expecting to hear some major announcements in but the Chancellor decided to leave things as they are with no changes being announced in the Spring Budget.

That implies that for the next house costing 650000 euros you can only take out a tax deductible loan of 650000 euros minus the 320000 euros gain which is 330000 euros. In this case all the conditions as provided in section 54 are satisfied and hence Kumar HUF can claim the benefit of section 54 by. Anti-Flipping Tax on Principal Residences.

This benefit is available only to an individual or HUF. Combining Bidens proposed capital gains tax with the existing estate tax law which says that if you die with over 117 million in assets that amount is taxed once at a 40 rate some wealthy. This spread has led many taxpayers to deliberately create capital gains as a form of remuneration from their company.

This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax bracket rate of 37. Sale price 600000 Stepped-up original cost basis 500000 100000 taxable capital gains. Capital Gains Tax Budget News.

Soldier For Life Fort Campbell. The CGT annual exempt amount therefore remains frozen at. The Center Square The Washington State Economic and Revenue Forecast Council ERFC adopted an official outlook based on the 2022 supplemental budget that continues to assume capital gains tax.

Presently the capital gains inclusion rate for realized or deemed realized capital gains is 50. The stepped-up cost basis. The IRS taxes short-term capital gains like ordinary income.

Opry Mills Breakfast Restaurants. On the other hand similar returns from unlisted shares are taxed at 20 if the holding period is at least two years. Govt starts work to bring parity to long-term capital gains tax laws.

If you sell it you would owe capital gains taxes only on 100000. NewsNow aims to be the worlds most accurate and comprehensive Capital Gains Tax news aggregator bringing you the latest headlines automatically and continuously 247. Restaurants In Matthews Nc That Deliver.

Capital gains help produce record tax haul 2022-05-10 - By Laura Davison. Currently returns from listed stocks or shares are taxed at 10 if they are held at least for a year. The Democrats are also proposing to add a 3.

Capital gains tax out of firing line in Budget. The surge in individual stock trading by Americans last year contributed to a record tax haul for the federal government this spring shrinking the budget deficit and surprising Wall Street but likely leaving President Joe Biden in. News Capital Gains Tax Spring Budget 2022.

Trump asked Treasury to look into easing capital gains tax. This is expected to benefit. Income Tax Rate Indonesia.

Relevance is automatically assessed so some.

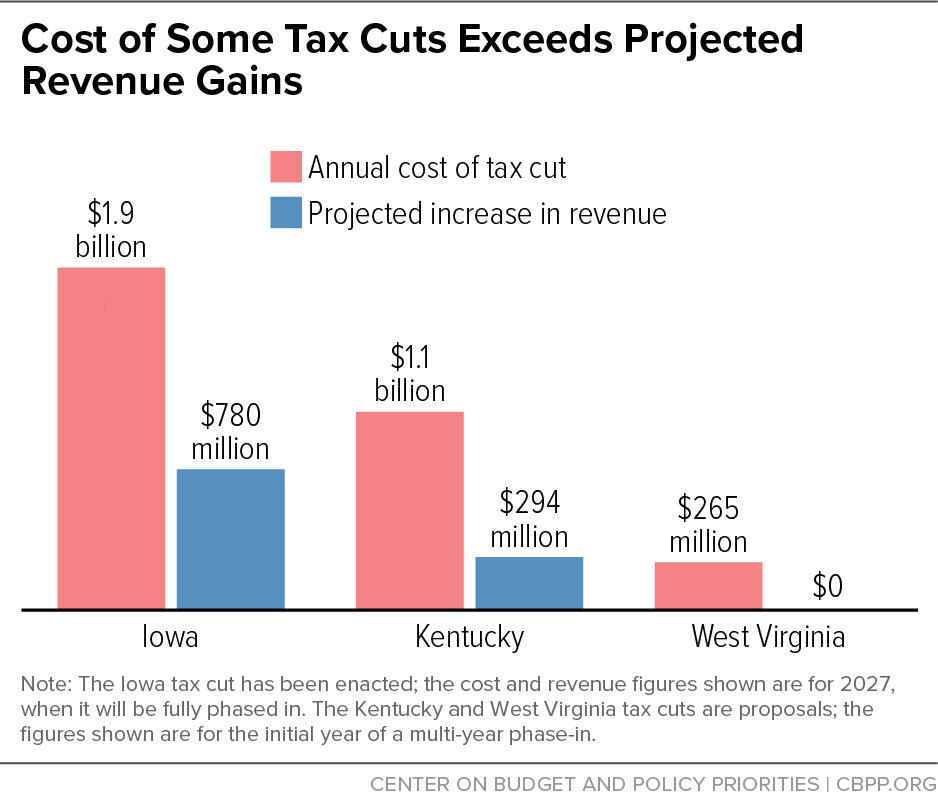

States With Temporary Budget Surpluses Should Invest In People Not Enact Permanent Tax Cuts Center On Budget And Policy Priorities

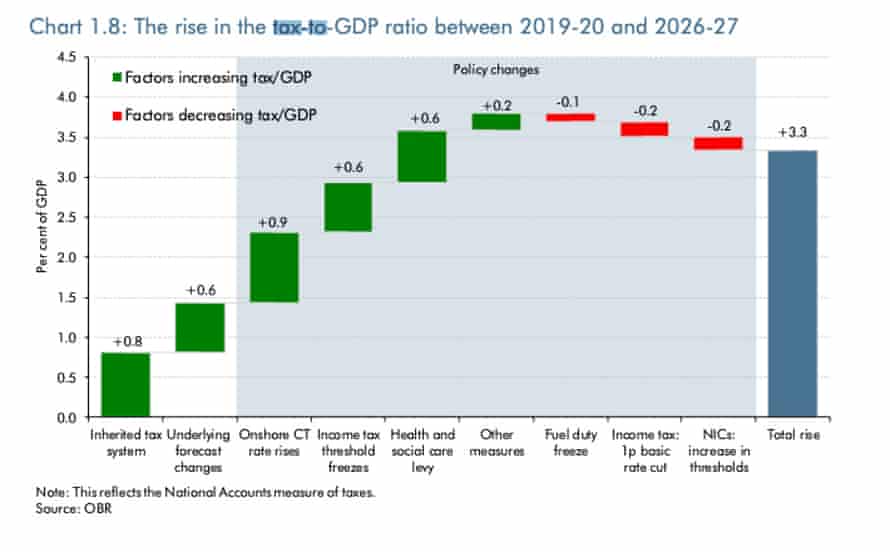

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

What Could Be In The Federal Budget Wolters Kluwer

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

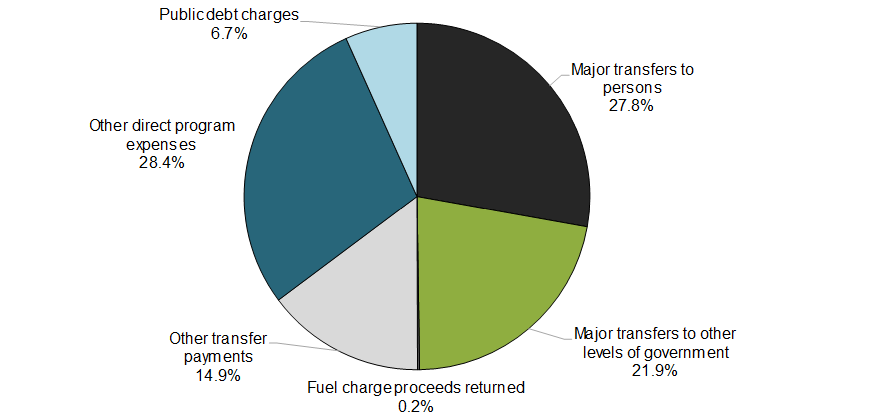

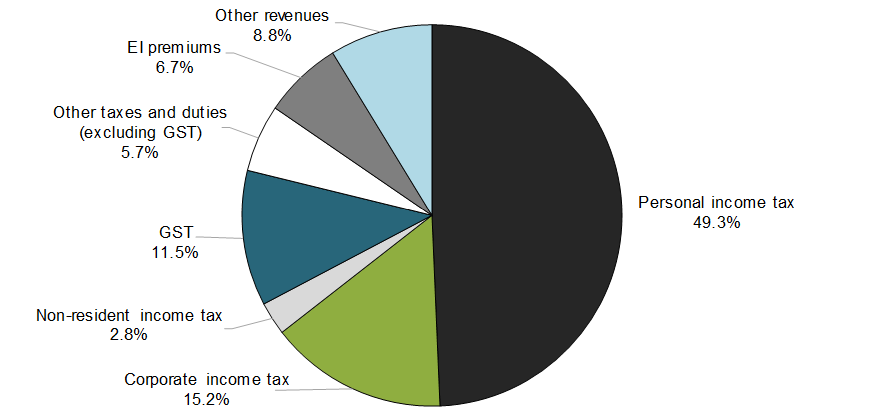

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Budget 2022 News And Updates Finance Secretary Tv Somanathan Clears Air On Mgnrega Allocation The Economic Times

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Tax Measures Supplementary Information Budget 2022

Annual Financial Report Of The Government Of Canada Fiscal Year 2018 2019 Canada Ca

Federal Budget Tax Changes 2022 Canada

Union Budget 2022 23 Capex Push

Direct Tax Proposals In The Finance Bill 2021 Finance Tax Proposal

Income Tax Changes Announced In Budget 2022 Cryptocurrency Tax New Itr Rule Ltcg And More

A Big Mistake Joe Biden Wants To Hike Capital Gains Taxes Capital Gains Tax Germany And Italy Capital Gain

Analysis Of President Biden S 2023 Budget Center On Budget And Policy Priorities

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times